President Trump: Trust Your Bipartisan Populist Instincts on Tax Reform and Balancing the Budget

Here's an idea for you.

President Trump, I’ve been encouraged by rumors that you would like to lower or eliminate taxes on incomes under $100,000 and raise them for higher incomes. I was also extremely excited when you declared that your Big Beautiful Budget would be balanced; something that hasn’t been done in 24 years.

But your administration, Congressional colleagues, and DOGE advisor have utterly failed to deliver. They can’t balance the budget with just spending cuts. Fact. But your gut is telling you that you need to slash taxes for tens of millions of voters, who are losing faith that you are a winner. That means somebody has got to pay more in taxes, and you know it has to be the high earners. But Mike Johnson is giving pushback, smiling in your face while you are glaring at him. That photo below is not a good look.

I say, turn a deaf ear to the calls for “big spending cuts and no new taxes” of the Freedom Caucus, Tea Party refugees, and lone wolf libertarian You Know Who. Why not tell them all: “I gave Elon Musk a chainsaw and a hand-picked SWAT team two full months to cut a trillion and they couldn’t convince anyone that they found even the $150 billion they said did, and now we’ve got protests all over the country, and my polls are hitting record lows. Which one of you geniuses (maybe you Massie, with your MIT degree) is going to succeed where Elon failed? I didn’t think so.”

Here’s a potential solution, with help from AI known as ChatGPT.

Brackets, Taxes, Voters

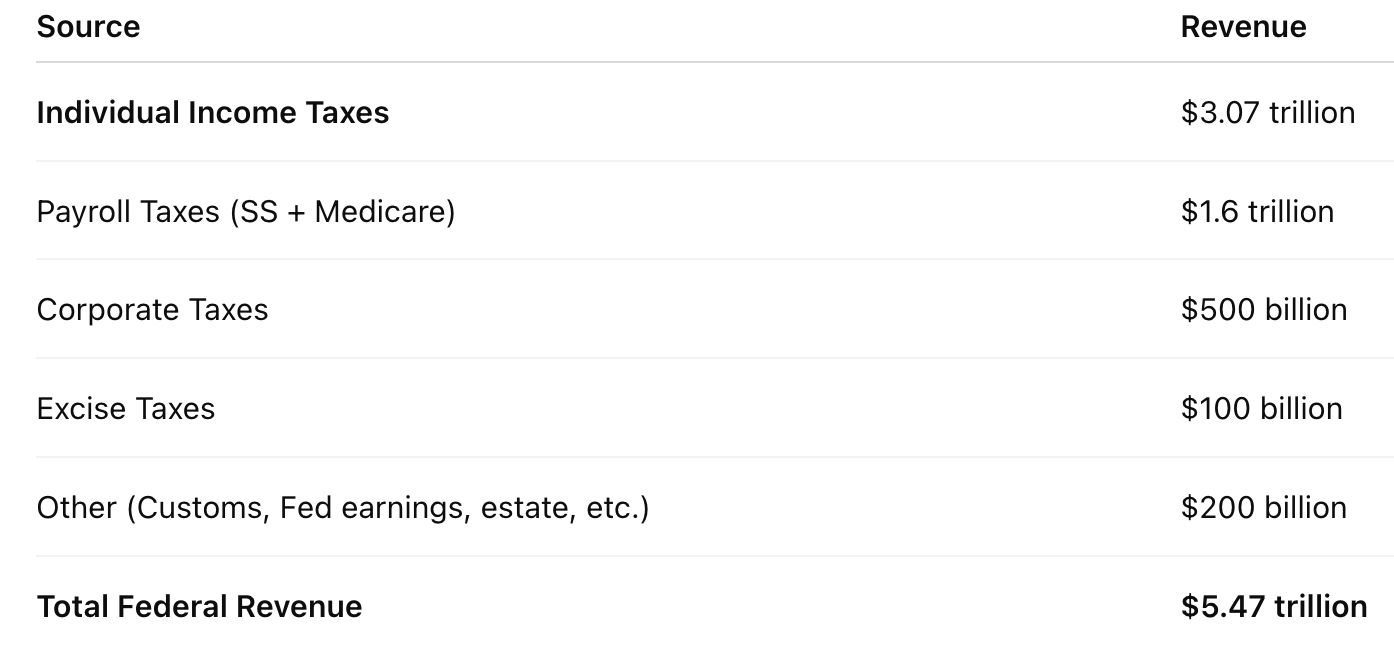

Let’s start with the 60 million households who make less than $50K. That’s just over half of all households (118 million). If everyone in those 60 million households vote for you, you win the popular vote. So we cut their tax to zero and deliver. There is a very big bonus for eliminating taxes for more than half of the voters: you no longer have to fear high voter turnout. In fact, it will favor you. No more accusations of voter repression, tossing out votes, recounts, lawsuits. Everyone wants to vote for no taxes, especially those struggling financially. (See figure below).

Next, we move to 30 million more households; the ones from $50,000 to $100,000. They pay no tax for the first $50,000, then, they pay 20% (1/5) for the part above $50,000. That means that even if they make another $50,000, that’s only $10,000 in taxes for that portion, and we’re done. $10,000 in taxes on $100,000 gives an Effective Tax rate of 10% (see the second line of the figure below).

That means that 60 + 30 = 90 million households out of 118 million pay less than 10% income tax, with the majority paying nothing at all. How can you lose an election on that kind of tax cut for that many households?

Now we move up to middle class ($100K to $250K) with 20 million households. Their marginal tax would be 35%, but an effective rate of 24%. What’s to complain about that? Now we’ve accounted for 110 out of 118 million households.

Next, the upper middle class ($250K to $500K, 5 million households). They get a 40% marginal rate, and effective rate of 33%. That should be tolerable; it’s about average for other countries (see figure below from the Tax Policy Center). We’ve now accounted for 115 million of 118 million households.

Now we come to the well to do and wealthy. All we ask these folks to do is pay taxes like in most European countries: 40-50% (marginally 40%, 45% and 50%, but effectively 41%, 48%, and 49%). There’s no sense in moving away of the USA. They might howl, but they are only 2.75 million households. They don’t have the votes. You and the rest of the voters have all the leverage. This is 21st century bipartisan populism, and you are inventing it. What leverage does Mike Johnson have, to stop you?

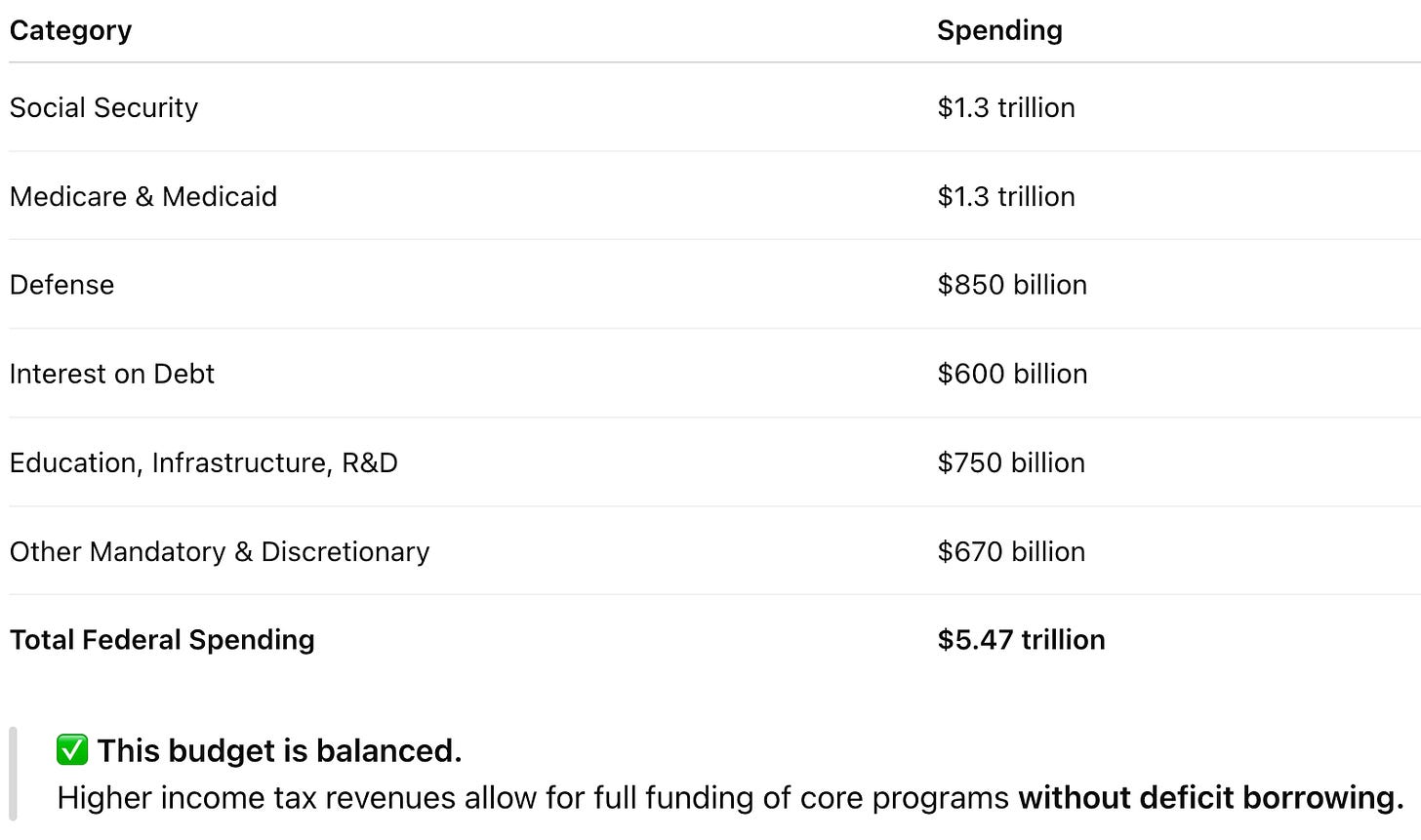

ChatGPT gave me these figures to fill out the budget at a very high level.

Add other Federal Revenue Sources (2025 Projections)

Add other Federal Revenue Sources (2025 Projections)

🧾 Summary

Do this, and you can say that you accomplished in one year what took Clinton eight. That ought to feel good. Sure beats, “Trump beat Hillary, but he couldn’t beat old Slick Willie.”