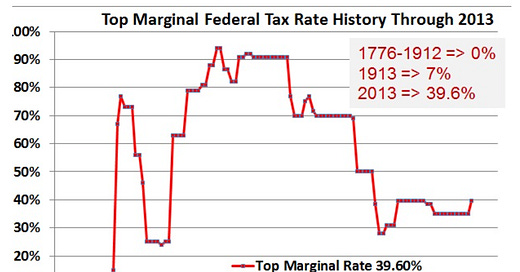

History of Top Marginal Income Tax Rate

High taxes on the rich do not kill the economy, not even if you're climbing out of a Worldwide Depression.

I promised a couple of days ago to look into the top marginal income tax rate in 1980. Was it really 70%? You bet. Moreover, it was 70%-80% going back from 1980 to 1964. In fact, it was 63%-92% from 1932, early in the Depression, to all the way to 1980.

My sources are the Tax Policy Center of the Urban Institute of Brookings Institute and For Best Advice.

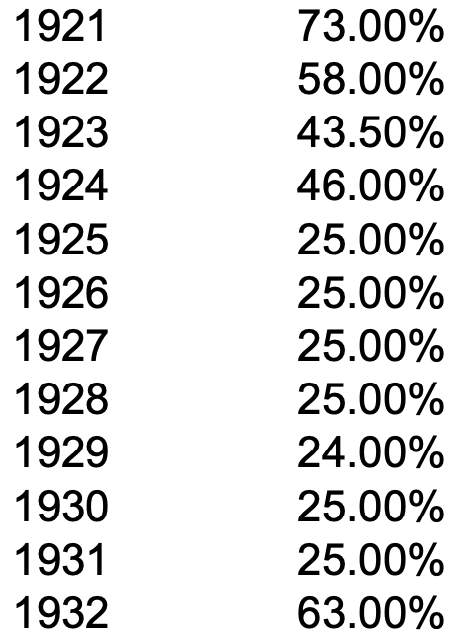

What about that huge dip during the “roaring 20’s?” At first glance, I thought it must have been in order to stimulate the economy during the depression, but on a closer look it appeared that the cut was before 1929. So I looked up the raw data. What a surprise. The precipitous drop in top marginal tax rate happened in 1922-1924, during the most financially corrupt Presidential administration up to that point in American history: that of Warren G. Harding.

Harding died in office on August 2nd of 1923, just as the Teapot Dome scandal was coming into the light. The scandal was that in exchange for cash, bonds, and a few head of livestock, Albert Fall, Warren G. Harding’s Secretary of the Interior, became the first Cabinet member to be convicted of a crime and jailed. Mr. Fall illegally transferred Federal oil reserves set aside for war time use by the Navy to two friends without bids or consultation with the Navy.

It is interesting that in his first full year in office (1924, an election year), Coolidge raised the top marginal tax rate from 43.5% to 46%, during the election. Soon after he took office again, he cut the top rate almost in half: to a ridiculous, record-setting 25%! That is odd. Raise taxes during an election year, then cut after the election? My guess is that a 1920’s version of Ross Perot was pulling Teddy Roosevelt Progressive Republicans from Coolidge’s Republican Party base. Coolidge apparently ran on a “fair-share tax hike for the wealthy,” to appease the Progressive Republicans, and smacked them in the face as soon as the election was over. The rich were really rubbing it into the faces of the working class. From Wikipedia:

Bottom line: Taxing the rich does not kill the economy. We don’t need and we can’t afford to keep the 2017 Trump Tax Cut. But we do need more, much more tax revenue if we are ever going to balance the budget. Even huge, disruptive, reckless spending cuts are not going to be enough and are ill-advised.

P.S. As fate would have it, I just received this from the Congressional Budget Office. Stay tuned for this and more from the CBO.

P.P.S. I discovered after publication that I did not link to “For Best Advice’s” graph and did not cross-check the raw data for that graph with the raw data from The Policy Center (TPC). I just now checked every data point and there were only four discrepancies, which do not change the substance of the analysis in my opinion. The left hand is the TPC data, which I presume is better than the “For Best Advice” data.

1922: 58.00 vs 56.00 ; 1923: 43.50 vs 56.00 ; 1950: 84.36 vs 91.00 ; 2001: 39.10 vs 38.60